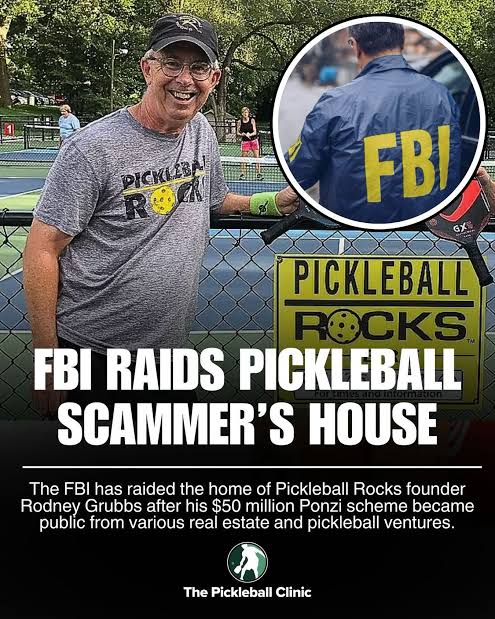

**BREAKING NEWS: Pickleball Company Owner Waives Discharge of Over \$47M in Unsecured Debt After USTP Investigation — FULL DETAILS**

By Jordan Hayes | June 12, 2025

—

In an unprecedented financial twist that has sent shockwaves through the burgeoning pickleball community and investor circles alike, Rodney “Rocket” Grubbs, the charismatic yet controversial founder and CEO of Pickleball Rocks — officially known as All About Pickleball LLC — has formally waived the discharge of over \$47 million in unsecured debt. This dramatic move follows a months-long investigation by the United States Trustee Program (USTP), shedding new light on one of the most baffling corporate collapses in recent sports-entertainment history.

### The Rise and Fall of a Pickleball Empire

Rodney Grubbs, a former collegiate athlete turned entrepreneur, burst onto the pickleball scene in 2018 with a vision to transform the sport from a casual backyard pastime into a global competitive phenomenon. Leveraging his passion for the game and a knack for marketing, Grubbs launched Pickleball Rocks with a simple mission: provide high-quality pickleball equipment, training programs, and competitive tournaments under one roof.

By 2021, Pickleball Rocks had become a household name in the pickleball world. Grubbs’ innovative product lines, ranging from paddle designs engineered with cutting-edge materials to subscription-based coaching apps, attracted tens of thousands of players. The company’s annual revenue reportedly soared into the tens of millions, and Grubbs was lauded as a visionary entrepreneur by media outlets and fans alike.

However, behind the public acclaim lurked cracks in the foundation of Grubbs’ empire. Rumors began to surface in late 2023 about delayed payments to suppliers, unexplained shifts in corporate leadership, and increasing investor frustration over returns on loans extended to Pickleball Rocks.

### A Complex Web of Debt and Allegations

The financial unraveling accelerated dramatically in early 2024 when dozens of investors filed complaints alleging that Grubbs had solicited millions of dollars through high-interest, short-term promissory notes. Investors, many of whom were enthusiastic pickleball players and community members, had reportedly been promised returns as high as 18% annually, with repayments scheduled within 18 months.

According to court documents obtained by this publication, Grubbs raised approximately \$47 million from over 300 individual and institutional investors. The funds were supposed to fuel new product development, expand tournament sponsorships, and grow Pickleball Rocks’ retail footprint. Instead, investigators found a maze of financial mismanagement, undocumented transfers, and personal expenditures camouflaged as business expenses.

The U.S. Trustee Program, tasked with overseeing bankruptcy proceedings and ensuring fair treatment of creditors, launched an exhaustive inquiry after the company was forced into Chapter 11 bankruptcy protection in February 2025. During the investigation, Grubbs disclosed assets totaling just \$1.6 million, including real estate holdings primarily in Indiana and Florida, a stark contrast to the massive liabilities on record.

### Discovery of Discrepancies and Poor Record-Keeping

Key to the USTP’s probe was the discovery that Grubbs had maintained financial records on a basic Excel spreadsheet rather than through standard accounting software. This revelation raised immediate red flags for forensic accountants, who noted numerous inconsistencies and unexplained transactions. For instance, a \$70,000 transfer to an equity trust account in December 2024 could not be substantiated with any business rationale.

Moreover, Grubbs’ declaration of property ownership conflicted with public real estate records, further complicating asset valuation. The investigation uncovered that several properties listed as business assets were actually owned by family members or third parties, blurring the line between personal and corporate finances.

Legal experts suggest these findings may point to potential fraud or at least reckless financial stewardship, though criminal charges have not yet been filed.

### The Waiver: A Game-Changing Decision

In an unexpected development during a bankruptcy court hearing last week, Grubbs announced he would waive the discharge of his unsecured debts — a move rarely seen in cases of this scale. This waiver means Grubbs is voluntarily relinquishing his right to be relieved of paying back the \$47 million owed to creditors, including hundreds of investors, business partners, and even his own family members.

Court analysts believe this decision could expedite the liquidation process, allowing for a more equitable distribution of any recoverable assets to creditors. It also signals a potential shift in Grubbs’ legal strategy, possibly in response to mounting pressure from the USTP and investor lawsuits.

Speaking outside the courthouse, Grubbs addressed reporters with a statement that balanced accountability and hope for redemption:

*”I acknowledge the mistakes and missteps that have brought us here,”* he said. *”Waiving the discharge is the right thing to do for the investors and community who believed in Pickleball Rocks. My goal now is to cooperate fully and work towards making amends.”*

### Impact on the Pickleball Community and Industry

The fallout from this scandal has rocked the pickleball industry to its core. Pickleball Rocks, once a shining beacon for players and entrepreneurs, has shuttered most of its retail operations and canceled upcoming tournaments.

Many players, coaches, and vendors who depended on Pickleball Rocks for income and exposure now face uncertain futures. Social media platforms are flooded with stories from those who lost money or business opportunities tied to the company.

At the same time, industry leaders are using the debacle as a cautionary tale. The National Pickleball Association issued a statement urging greater transparency and regulatory oversight within the sport’s commercial ecosystem.

### What’s Next? Legal and Financial Battles Loom

Despite the waiver of debt discharge, numerous lawsuits remain pending against Grubbs and Pickleball Rocks. Investors are seeking to trace remaining assets and hold Grubbs personally accountable. Bankruptcy attorneys warn that recovering significant funds will be difficult given the company’s limited assets and complicated financial history.

Federal investigators continue to examine the case for possible criminal wrongdoing, including securities fraud and misappropriation of funds. While no indictments have been announced, experts suggest charges could be forthcoming if investigators uncover further evidence.

### Lessons Learned and Moving Forward

This case underscores the risks inherent in high-return investments within niche markets, especially those fueled by passion rather than rigorous financial controls. The Pickleball Rocks saga is a stark reminder that enthusiasm and innovation must be matched with sound business practices and accountability.

For the pickleball community, the hope is that the sport can emerge stronger, with greater safeguards to protect players, fans, and investors alike. As for Rodney Grubbs, the coming months will likely define his legacy — either as a cautionary figure or a man seeking redemption through transparency and restitution.

—

**Jordan Hayes** is a business and sports investigative journalist with over a decade of experience covering entrepreneurial ventures and industry disruptions.

—

If you want, I c

an expand on any part or spin it in a different tone — just let me know!